On March 19, the Toronto Star published The Ford government is overhauling Ontario’s blue box recycling program — and critics say it will be a disaster, by Business Feature Writer Richard Warnica.

The Paper and Paperboard Packaging Environmental Council (PPEC) was interviewed for the article on February 4, but our comments about paper-based packaging in Ontario’s Blue Box program, including concerns over the new paper targets and the importance of the consumer role, were not included.

The focus of the detailed article is primarily about the multiple Producer Responsibility Organization (PRO) model, and the confusion surrounding the final Blue Box regulation, which was released in June 2021, and sets out the framework to transition to a producer responsibility model.

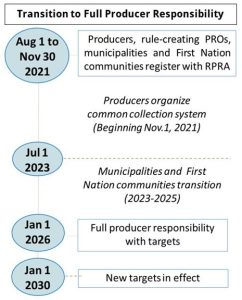

The new model will transfer the full operational and financial management of the Ontario Blue Box program to producers, with implementation beginning July 2023.

It marks a significant change from the existing shared model, which sees producers pay 50% of municipal Blue Box costs. Producer responsibility for packaging and printed paper is not new, with British Columbia being the first province to implement a full 100% industry funded and controlled program in 2014, run by Recycle BC.

But back to the Star article. The general feeling is that the new regulation is confusing.

Jo-Anne St. Godard of the Circular Innovation Council (formerly Recycling Council of Ontario) said: “This is the most bizarre approach to packaging regulation and EPR we’ve seen.”

Denis Goulet of Miller Waste Systems said: It’s confusing to people who’ve been in the industry for 30 years.”

Duncan Bury, a consultant specializing in producer responsibility, said: “What they’ve developed is way more complicated than it needs to be, and I think there’s real worries about how this will actually roll out.”

Warnica writes that the confusion could have consequences, including meeting regulated timelines and potentially higher costs:

“It would force some municipalities to sign expensive contract extensions with existing suppliers…or work out new deals in a tight market already constrained by supply chain backlogs.”

Multiple PROs…and David vs. Goliath?

Part of the confusion and complexity, some say, have to do with having a multiple PRO model, versus the current single PRO model, which is also the case in British Columbia.

The PROs that have registered to date include: Circular Materials Ontario, a not-for-profit created and governed by producers; Resource Recovery Alliance, owned and operated by GFL Environmental; and Ryse Solutions Inc.

Warnica’s article quotes Patrick Dovigi, CEO of GFL Environmental, who said: “The government at the time decided to go out with multiple PROs because they think it created competition…. All the multiple PROs dynamic does is create inefficiencies where all the costs really are.”

The article speaks to specific concerns regarding GFL. First, that their PRO may create a conflict of interest – ie. having a waste management company operate a PRO who is also contracting out business to waste management companies – and second, that they could have an unfair advantage given their size.

Jo-Anne St. Godard explained it this way: “I think you need to be able to have separate church and state,” going on to say “if you have a monopoly service provider, or one that has a very big dominant position, the buyers of that service may find themselves only having one price-taker effectively.”

In the article, Dovigi refers to himself as David, as in David vs. Goliath, with Goliath being the major producers.

Dovigi went on to say: “People are making me out to be the bad guy…and we’re just little GFL from Toronto.”

As the article points out, GFL is the fourth largest waste management company in North America with a market cap of $12.3 billion. GFL also completed 46 acquisitions in 2021, and are planning another 25-30 deals this year, according to Waste Dive.

But back to the issue of competing PROs. According to the article, both the Resource Recovery Alliance and Circular Materials Ontario have requested changes to the regulation, specifically “to reverse the central tenet calling for competing PROs, and to impose a single Producer Responsibility Organization to oversee the entire system.”

Though not everyone agrees with that. The Ontario Waste Management Association (OWMA) reaffirmed its support for the current Blue Box regulation. OWMA wrote a letter to Minister Piccini that they do not support any amendments to the regulation \”that would create uncertainty for public and private waste service providers and residential customers.\”

PPEC Concerns with Paper Targets and Needing to Recognize the Role of the Consumer

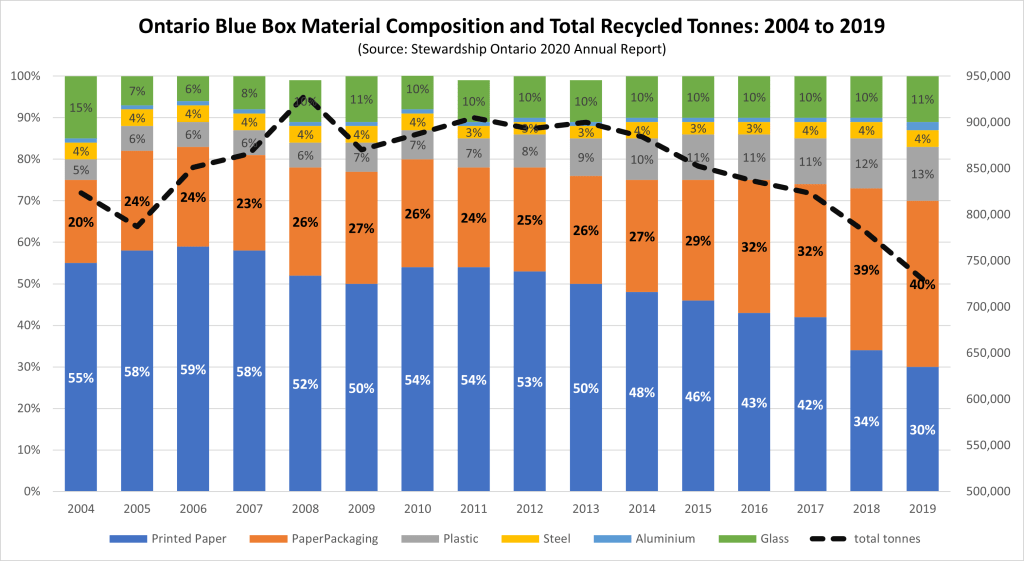

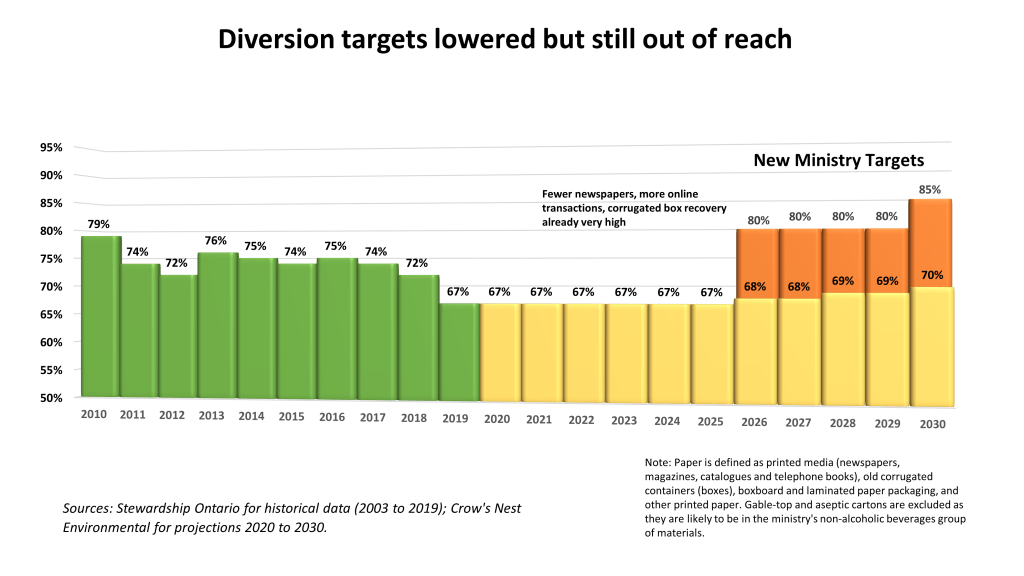

When PPEC spoke to Warnica in February, we talked about our concerns with the feasibility of meeting the new Ontario paper diversion targets (80% for 2026-2029, and 85% for 2030 and beyond). The below graph plots the material composition of the Ontario Blue Box program (stacked bar) and total recycled tonnage (broken line) from 2004 to 2019. Paper is the largest component of the Blue Box (the orange and blue), but the overall composition of the paper category has been changing for years, which impacts diversion. Printed paper makes up much less of the Blue Box than it used to, and paper packaging has doubled, while overall recycled tonnes are on a downward trend.

With less being collected in the Blue Box, such as newspapers, while other categories, such as corrugated boxes already achieving 98% recovery from Ontario households (according to the 2020 Blue Box Pay-In Model), it begs the question of how will the overall paper diversion rate increase to meet the government’s new, higher targets?

PPEC commissioned a study, conducted by Dan Lantz at Crow’s Nest Environmental, to examine Blue Box diversion data to help determine if the government’s proposed diversion targets could be achieved. The study found that the proposed targets could not be met:

“A 90% target is unreachable. This would effectively require 95% of the population capturing and putting out for recycling 97% of their paper and making sure it is not contaminated at all. And then the recycling facility would have to capture 98% of all that paper (including paper that’s shredded) and send it on to the end-market.”

We also spoke about how the new model could help achieve harmonization through a more standardized system. There are 444 municipalities in Ontario, with 250 programs participating in the Blue Box program. That’s 250 separate programs, with different collection lists, and different approaches to educating their residents, aka the consumer.

And the role of the consumer is paramount to the success of any recycling program, including Ontario\’s Blue Box program. At the end of the day, it is the consumer who makes the decision of how to dispose of their waste and recyclables. The more aware and educated they are, the more likely consumers are to clean and empty their recyclables, and separate them from waste and organics. Standardization may help deliver a more uniform educational message to Ontarians, which could help increase diversion and reduce contamination (the higher the contamination, the harder it is to achieve better recovery rates).

The latest Ontario Blue Box data shows that the recovery rate increased slightly in 2020 to 59.9%, which means that a little over 40% of what is placed in the Blue Box ends up in landfill.

It goes without saying that it is in everyone’s best interest to ensure that programs run efficiently, are able to capture the value of materials, prevent recyclables from ending up in landfill, and ensure consumers understand their role.

PPEC will continue to monitor the developments related to Ontario\’s Blue Box regulation, and the transition to the new producer responsibility model.